NameScan Provides:

Why Conduct a ML/TF Risk

Assessment?

An Anti Money Laundering / Counter Terrorism Financing (AML/CTF) risk assessment will help you identify risks and develop policies and processes to help minimise and manage those risks. It is an unrealistic assumption that a reporting entity would have zero exposure to being used for money laundering and/or terrorism financing activities. As such, an organisation should identify the ML/TF risk as soon as possible and develop frameworks which can be used to prioritise and monitor their exposure to such risk.

Continuous Risk Reviews

An assessment of your ML/TF risk assessment must always be conducted before the introduction of any new product, channels, or the development of new techniques implemented to deliver your service.

In addition to periodic reviews of your systems and controls, there is a range of circumstances that can trigger an immediate need to review a product or channel’s ML/TF risk assessment.

How Can You Determine Your Inherent ML/TF Risk?

Once you have determined your inherent risk, you must utilise systems and controls to mitigate that risk. You can then determine the residual risk and apply risk management systems and controls to mange that risk.

Develop an appropriate risk assessment methodology or framework, which includes ways to measure the likelihood and impact of ML/TF risk.

Populate the model with all relevant risk and associated risk attributes.

Perform the risk assessment and ensure that its output align with the scoring or ranking mechanisms of the methodology or model.

Easily Assess Risk to Your Business

Have your business' inherent risk and current AML/CTF processes been reviewed? Our consultants can provide you with suggestions on ways in which you can manage and improve your current AML and KYC controls.

Our Features

Cost Effective Service

Access to experienced consultants, who will be able to provide you with recommendations on minimising your ML/TF risk at a competitive rate.

Region Specific

Work with a consultant who is familiar with your local legislation and is able to provide you with feedback on your specific AML/CTF obligations.

Tailored Consultation

Each consultation session will be tailored towards your specific business and the type of product/service you offer.

Comprehensive Framework

Access a structured and comprehensive framework to assess your compliance with Key AML/CTF requirements.

Residual Risk

Implement controls to address identified gaps in your compliance processes and reduce the residual risk associated to your business.

Identify Inherent Risks

Determine your inherent risk (vulnerabilities that exist within the market, sector, jurisdiction, etc.), before the implementation of an anti money laundering and counter terrorism financing program.

Triggers to Perform a Risk Assessment

Transform your inefficient KYC processes with real-time access to over 180 company registries that are continuously updated and configured to your specific needs.

Our Features

Increased customer base or increased use of your product or service

Change in the volume or value of transactions

Significant changes have been made to your product or service

Your transaction monitoring identifies unusual patterns

Your ongoing customer due diligence (CDD) checks show a pattern of unusual activity

Checks show an emergence of criminal exploitation of a product or service

External developments that result in the changing of your risk score

Law enforcement communications about the ML/TF risk for your product or channel

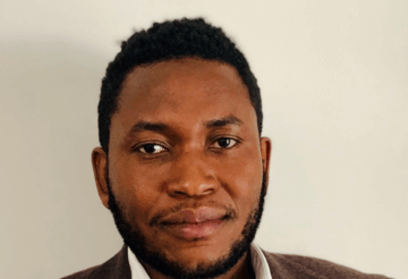

Meet Our Consultants

Work with our accredited consultants to assess the money

laundering and terrorism financing risk to your business.

Campbell is based in Auckland, New Zealand and has over 5 years of project-based experience in the AML/CTF industry. He has held his ACAMS accreditation since 2020 and has worked in various different industries including Finance, Banking, Telecommunications and retail. Campbell is able to perform Risk Assessment Consultations for companies located in New Zealand.

Carolina joins our consulting team from Uruguay. She has 2 years of experience in the AML industry. Specialising in the Crypto, Retail, FMCG, Business Intelligence and AI markets. Carolina can provide risk assessment consulting across Latin America with a key focus on Argentina, Uruguay, Mexico, and Colombia.

Delfina has 8 years experience with the AML/CTF industry. Joining our consulting team from Uruguay allows her to conduct risk assessments for clients based in several countries such as, Argentina, Uruguay, Colombia, Chile, Costa Rica, Mexico, Peru, Bolivia, and Paraguay. Delfina specialising in the crypto, finance and retail industries.

Francois joins our team from South Africa and has over 11 years of experience in the AML/CTF industry. Throughout his career Francois has worked primarily in the Banking and Insurance industry and understands the importance of having the appropriate AML/CTF processes in such heavily regulated industries. He has held his ACAMS certification for over 3 years and is able to perform Risk Assessment Consultations for companies located in Africa.

Sarkis has 15 years experiences within the AML/CTF industry. Based in Lebanon, Sarkis has worked in a variety of sectors including, banking, technology, risk management and compliance. He has held his ACAMS accreditation for over 5 years and can conduct risk assessments across the globe.

Tony is based in North Carolina, United States and brings to the table over 10 years of practical experience in the AML/CTF industry. Throughout his career he has worked in various industries with a strong focus on the banking industry in particular; retail, commercial and investment banking. Tony has held his ACAMS accreditation for over 4 years and is able to perform Risk Assessment Consultations for companies based in the USA and UK.

Alan joins the MemberCheck consulting team from Hong Kong. He has over 2 years experience within the AML/CTF industry, holding his ACAMS certification for roughly 9 months. Throughout his career he has worked in various industries with a focus on banking, finance, and industrial. Alan is able to conduct risk assessments for clients based in Hong Kong, Indonesia and Malaysia.

James joins our consulting team from India. He has over 8 years experience in the AML/CTF industry. Having worked in a range of industries including, banking, credit, compliance and wealth management. He has held his ACAMS certification for over 2 years, allowing him to conduct risk assessments across the globe.

Based in Wellington, New Zealand, Laura and has over 15 years of hands-on experience in the AML/CTF industry. She has worked in a various range of industries including; Banking, Insurance, Asset Management, Financial services and Capital Markets. Laura has held her ACAMS accreditation for over 10 years and is confident in performing Risk Assessment Consultations for companies in the MENA region, India, Australia, New Zealand and the UK.

Enquire about the Pricing for Our AML Consulting Service

Let our accredited consultants help manage your risk and provide you with the necessary steps required to mitigate as much inherent risk as possible. Fill in the form and one of our friendly sales representatives will get in touch with you soon.