Accounting sector in Australia is facing a significant regulatory shift. Under the AML/CTF Amendment Act 2024, accountants will soon be required to comply with stringent anti-money laundering obligations. Professionals in this sector must grasp their new duties and develop a strong, risk-based AML programme.

Risk Profile: Accounting Sector in Australia

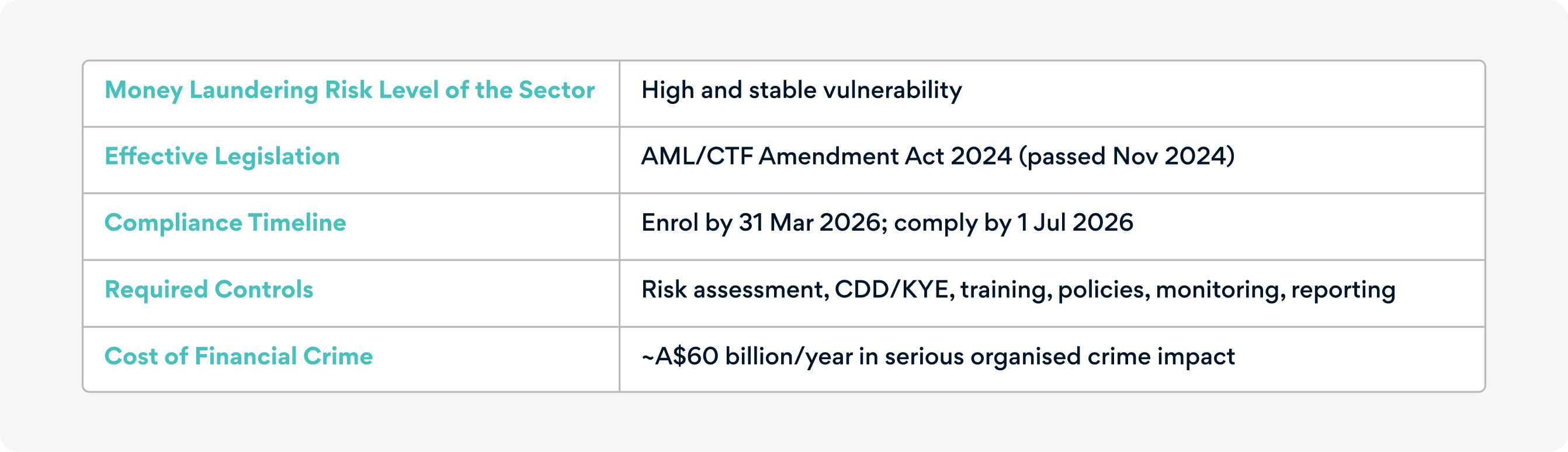

AUSTRAC’s 2024 National Risk Assessment identifies accounting professionals as having “high and stable vulnerability” to money laundering, consistently being identified as facilitators in the layering phase of laundering schemes. The profession is categorised as part of the “gatekeeper” sectors, alongside real estate agents, lawyers, and trust service providers, due to its key role in structuring complex financial transactions and legal entities. Criminal groups using accountants are associated with larger sums and cause 2.5 times more crime-related harm compared to groups not using such facilitators.

Legislative Reforms: AML/CTF Amendment Act 2024

Passed in November 2024, the AML/CTF Amendment Act requires accountants delivering certain specified services to become reporting entities under the AML/CTF regime. These reforms bring Australia in line with international standards and avoid potential FATF grey listing by 2026, which could reduce foreign investment by up to ~3% of GDP.

Accountants must enrol with AUSTRAC by 31 March 2026 and achieve full compliance by 1 July 2026.

Designated Services that Trigger Obligations

If accountants provide any of these designated services, they must comply with AML/CTF rules:

- Buying, selling, leasing or transferring real estate for customers

- Managing customer money, securities, trust accounts or other assets

- Establishing, operating or advising on trusts, companies or legal entities

- Facilitating financial transactions (e.g. mergers, acquisitions, business sales)

- Providing services for legal arrangements, such as nominee director/shareholder services

Typical Money Laundering Techniques in Accounting Practices

Criminals exploit accounting-related services via:

- False invoicing or fraudulent tax filings to layer illicit funds

- Creating trusts or shell companies to obscure beneficial ownership

- Misusing client trust accounts or company structures

- Engaging in international structuring, offshore transfers or exploitation of cash-intensive businesses

- Reluctant or weak KYC (Know Your Customer) and ongoing monitoring practices

Obligations for Reporting Entities

Accountants deemed reporting entities must implement:

- A comprehensive ML/TF risk assessment covering customer, transactional, geographic and business risks

- Customer Due Diligence (CDD) and enhanced due diligence, where applicable

- Transaction monitoring to detect suspicious patterns

- Timely reporting of suspicious matters to AUSTRAC

- Development of firm-specific AML/CTF programmes and policies

- Conducting periodic independent reviews (every 3 years and for higher risk every 2 years) and recording retention for at least 7 years

AUSTRAC will support entities through guidance templates, education sessions and risk-based compliance tools, especially for small and medium-sized practices.

At a Glance

The Australian accounting sector is recognised by AUSTRAC as a critical “gatekeeper” with elevated money laundering vulnerability. The AML/CTF Amendment Act 2024 introduces reporting requirements for specific services, with a compliance deadline of mid‑2026. Preparation is underway: risk assessments, policy frameworks, training, and AUSTRAC support programmes are essential to meet the new obligations and mitigate criminal exploitation.

Navigate the New Compliance Landscape Smoothly by Partnering with NameScan

NameScan helps businesses of all sizes – from small firms and mid-tier practices to large enterprises – navigate the complexities of Tranche 2 compliance with ease. Our flexible screening and verification solutions are designed to meet the unique needs of each organisation, ensuring they can identify risks, meet AML/CTF obligations, and remain compliant without unnecessary overheads. Our Pay-As-You-Go (PAYG) model allows businesses to access powerful compliance tools without committing to long-term contracts or large upfront costs.

FAQs

What is Tranche 2 in Australia?

Tranche 2 refers to the long-anticipated reforms to Australia’s Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) regime. Tranche 2 extends obligations to ‘Designated Non-Financial Businesses and Professions’ (DNFBPs), such as lawyers, accountants, real estate agents, trust and company service providers, and dealers in precious metals and stones.

Why is Tranche 2 being introduced?

Australia has been under pressure from the Financial Action Task Force (FATF) to bring DNFBPs into the AML/CTF regime, as these sectors are often exploited by criminals to launder money and finance terrorism. Tranche 2 aims to close regulatory gaps and strengthen Australia’s defences against financial crime.

Who will be affected by Tranche 2?

Lawyers, conveyancers, accountants, real estate agents, trust and company service providers, and dealers in precious metals and stones will need to comply with AML/CTF obligations such as customer due diligence, record-keeping, reporting, and risk assessments.

What obligations will businesses have under Tranche 2?

Obligations are expected to include customer due diligence (CDD), ongoing monitoring, suspicious matter reporting, record-keeping, and establishing an AML/CTF compliance program tailored to the business’s risk exposure.

How can businesses prepare for Tranche 2?

Businesses should start assessing their risk exposure, reviewing customer onboarding processes, and exploring AML/CTF solutions for due diligence and ongoing monitoring. Early preparation will make the transition smoother once the reforms take effect.

0 Comments